Lease Types and Occupancy Costs

When evaluating commercial spaces to lease, we think it is important for all parties to understand the total costs to lease the space and make informed decisions. Real estate professionals can provide comprehensive analyses that compare base rent, expense reimbursements, lease concessions, tenant improvement costs, and other property specific expenses such as private parking costs. In this article, we will define the most widely used lease types and compare how expenses are treated differently.

If there is any conflict in how the industry term is defined below versus in the lease document, the terms in the lease always prevail. If you ever have questions about any terms of the lease, always ask before signing the lease document.

It all comes down to occupancy costs

Lease Types Explained

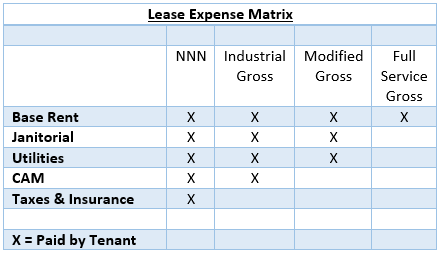

Not all leases are equal, but operating costs when comparing the different lease types can be very similar. The first table to the right (fig. 1.1) shows different types of leases; NNN, Industrial Gross, Modified Gross, Full Service. The property owner or their agent will quote a Base Rent amount and the operating expenses a tenant pays will be based on the type of lease stated above. The second table below (fig 1.2) gives a mathematical example of how, with the different lease types, the costs add up to the same overall cost.

Figure 1.1

Figure 1.2

Industrial Gross Error:

Many agents quote Industrial Gross as net of Janitorial and Electricity/Gas, but rent could also exclude HVAC maintenance, water, and garbage.

Be sure to ask.

So what goes into operating costs?

Base Rent—This is the rent a tenant pays and is stated in the lease. Real estate agents will quote this rent. Often we create a schedule or table to reference in the lease proposal and lease document to eliminate discrepancies or misunderstandings during the lease term.

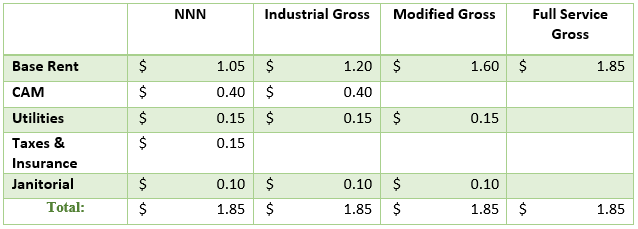

Base Year—The Base Year is the initial year of the lease and is used for Gross Leases to assist in calculating operating expenses. If the lease is executed and the tenant moves in to the property in 2016, then the base year would be 2016. The operating expenses in a Base Year is paid for by the Landlord and calculated in the Base Rent

The landlord calculates the operating expenses for each subsequent year of the lease (“Comparison Year”) and compares the operating expenses paid Base Year. See the table below

Figure 1.3

In an office lease, the tenant is responsible to pay for the difference in operating expenses from the Base Year and the Comparison Year. This amount the tenant pays is often referred to as “operating expense pass throughs” because the cost of the increase in operating expenses is “passed through” and paid for by the tenant.

Pro Rata Share—this is the percentage of rented space to the total property square footage (fig 1.4). Pro rata shares are important for tenants and landlords to portion costs as a percentage of occupancy. Leases will state the total project square footage and the pro rata share as a percentage of the total.

Figure 1.4

Other terms you may hear:

Common Area Maintenance. This refers to the maintenance of all shared areas such as lobby areas, shared restrooms, elevators, stairs, building exteriors, sidewalks and parking lots.

Additional Rent. This refers to anything to be paid by the Tenant in addition to Base Rent. Examples of Additional Rent are: operating expenses pass through, reimbursed expenses, and any extra services.

Leases will gross up variable expenses to assume the property is at full occupancy. This protects the tenant from paying more than their pro rata share of fixed expenses, especially in times when buildings have high vacancy. Typically we see leases grossed up 95% to 100%.

Some properties have a specific cost as the base instead of a cost during a specific year. If the cost to operate the property exceeds the base stop the tenant pays the difference. Only Bishop Ranch uses this method. We don’t see this too often in our market.

If you want to learn more about Expense Stops this article goes into more detail (Click Here)

More common in single tenant buildings, these leases require tenant to pay all expenses including reserves for major capital items like roof, equipment and parking lot. Most leases make the landlord responsible for structural components like walls, roofs, and foundations.

Replacement of structural elements like roof, parking lots and HVAC systems. Major repairs or mandatory code upgrades like handicap walkways and restroom remodels.

Not all capital items are bad. Sometimes Landlords can do improvements which save on operating costs and the savings are rebated back to the Landlord. What usually is not included in operating costs are common area improvements that are structural in nature, a tenant improvement, or any improvement with a useful life over 5 years unless it is amortized over its useful life. What we don’t like seeing are capital projects expensed in one year at a big cost to the tenants. Items classified under 5 years are typically HVAC equipment or lighting and these acceptable to expense in the year of the cost. Some agents try to eliminate all capital costs from leases, we think this is a mistake, some costs are necessary to the smooth operation of the property and as long as the manager is consistent with their approach, Tenant will see modest increases.

We like landlords to maintain expenses in their operating costs and build reserves. It means that the landlord is considerate of the property and the inevitable replacement of major components. As HVAC equipment gets older the cost to maintain it goes up. Building a prudent reserve allows both the property to replace or repair capital items routinely and keep the property in good condition. Prudent managers will competitively bid vendors every couple years. They will establish a capital budget and understand the remaining useful life of the building components and keep a reserve. Doing this keeps expenses as level as possible.

These are those costs typically contracted by the Landlord. Obviously there are market forces for any expense. In 2000 we saw electricity costs in California double and after 9/11 insurance rates went up. Controllable is a very subjective term. Often we are negotiating a 3-5% cap on controllable expenses. Some owners will agree to an annual cap above the base and some want a cumulative cap. Either way, know that cap of operating expenses are subject to market forces and are not always negotiated in leases.